I've been asked before to write about bitcoin. I'm not quite sure where to start other than a stream of consciousness of why I think cryptocurrency is the logical next evolution of our financial system. Is bitcoin here to stay? Will bitcoin define commerce of the next 1000 years? The jury's still out, though, there is promising signs that shared consensus will soon make it's way into several facets of our lives.

WHAT IS BITCOIN AND WHY IT'S IMPORTANT

To share what bitcoin is, one must begin with what bitcoin is not. Finding a means of transfering balance electronically is not a new problem for cryptography -- it has been a foundational problem for many years. Starting in the 80's, people began to say, "Let's create a digital class of assets. It shall be a secure means of transfer, it shall be a cryptographically sound evolution of trust."

Off to the races they went. We've had digital means of transfering value for quite some time, but the problem is that there has never been a means of doing so without a third party, that is, transfering value without first validating through a central authority.

What bitcoin brings to the table is a decentralized solution. Decentralized means there is no central authority. There is no FED. There is no uncle sam that says "this dollar has been spent, this dollar has not." The current methodology puts these central authorities i.e. visa, amex, mastercard, wells, name your financial institution, in charge.

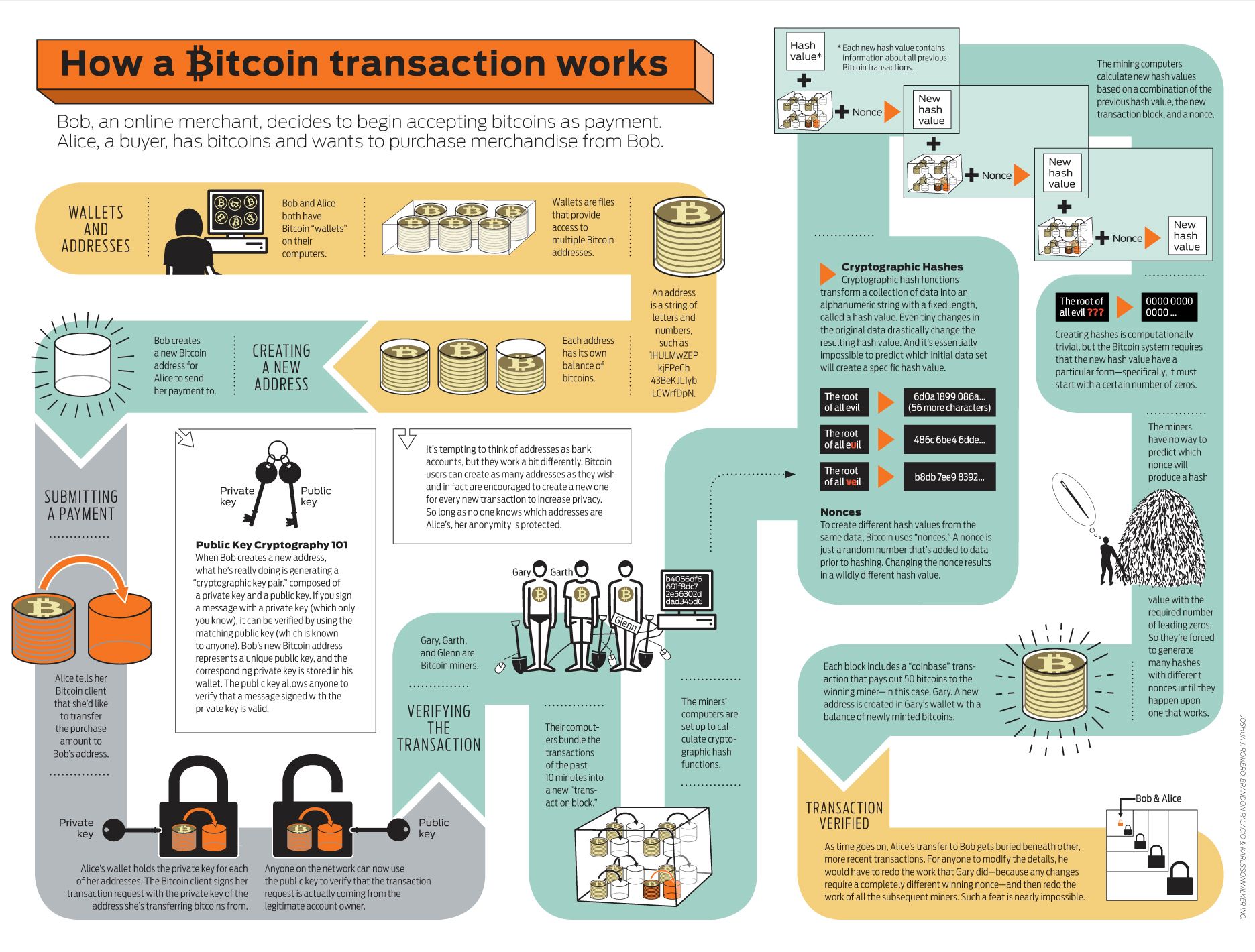

But how? How can this possibly be accomplished? Through a breakthrough technology named by the bitcoin protocol as the blockchain. An in depth explanation would involve describing the evolution of cryptography, public/private key sharing, and difficult algorithms that make a persons head spin so fast it's difficult to keep your bearings. Simply put, the blockchain comprises ALL TRANSACTIONS since the beginning. Every. Single. Transaction. To be checked, authorized, validated, by all participants in the network.

This protocol solves two important solutions to two difficult problems: 1) how do we keep this thing afloat i.e. in check and 2) how do we incentive the computing power necessary to keep commerce alive.

Item I: The transaction protocol of bitcoin ensures that transactions are legitimate, that is, transactions have originated from a person who's good for their funds and destined for a valid "address." This is much like sending an e-mail: who did it come from and where is it going?

Item II: These transactions are kept straight by incentizing computing power through a difficult algorithm, illustrated thus by a large puzzle. There is a missing part that must be found in order to legitimize (set in stone) the transactions taking place. In the bitcoin protocol, these puzzles strive to be 10 minutes "hard." That is to say, every 10 minutes on average a "block" of transactions is legitimized, and the computing power that has found the piece of the puzzle (in the form of a cryptographic hash) that cryptographically sets these transactions in stone is rewarded. The reward started at 50 coins, and is halved every so often, currently being 25 per block solved.

WHY? THE DOLLAR, GOLD, AND OTHER MEANS OF TRANSFERRING VALUE WORK WELL. THEY ARE ESTABLISHED. WHAT ARE THE INTENTIONS OF SUCH A TECHNOLOGY.

Not so fast. Where do these assets come from? What is stopping counterfeit? Ownership of these means of transfer is big business. Perhaps it's time we ought to ask who's interests they intend to protect.

(to be continued)

No comments:

Post a Comment